business insurance car auto low cost auto

business insurance car auto low cost auto

Power publishes one more highly regarded tally of client fulfillment in an effort to figure out which firm supplies the most effective auto insurance policy. J.D. Power's 2020 united state Auto Insurance Policy Research checked more than 40,000 consumers throughout the country much less than half as many as the Consumer Reports study from February-March 2020. This yearly study analyzes consumer fulfillment in 5 aspects (in indexed order): Invoicing procedure and also policy details, Cases, Interaction, Policy offerings, Rate The fact is while you have nationwide gamers advertising on television we're discussing GEICO, Progressive, Allstate, State Ranch as well as others a lot of the vehicle insurance coverage industry is regional.

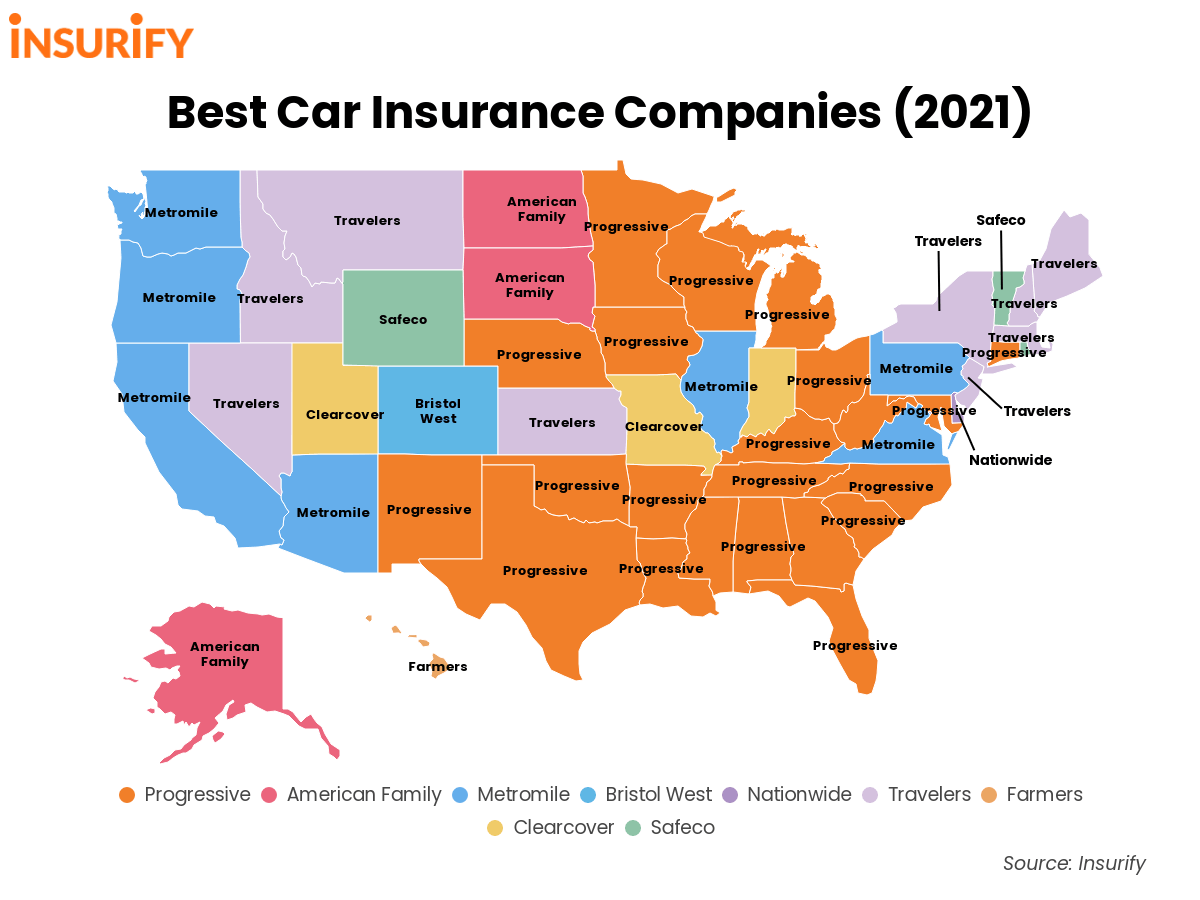

Here are its leading insurance firms by region. We've detailed only those that racked up greater than the standard in their corresponding regions. You'll see a different number of access depending on which part of the nation the companies run.

Below are the positions: (# 1 is ideal) (# 1 is worst) Safeco, Mercury, Travelers, Progressive, Farmers, Automobile Club of Southern The Golden State Insurance Policy Team, Freedom Mutual, Allstate, State Ranch, Met, Life Clark says that shopping your insurance coverage every three years is an excellent way to conserve cash. Here's exactly how to start the procedure: Once you have a listing of candidates chosen from the ratings over, you'll wish to start obtaining quotes.

Have your newest plan in front of you in case any type of questions come up concerning the make and also version of your car(s) and also your present protection. Dealing with an insurance coverage broker is an additional choice - auto. You can get several quotes, and you'll have accessibility to all the insurers the broker collaborates with.

As soon as you obtain the quotes, it's time to compare them. Each quote ought to be based upon the same amount of protection so you can do an apples-to-apples contrast. One tip: If you possess a house, have cash in savings, and so on, you absolutely desire even more than the state minimums for liability. trucks.

Facts About How Does Car Insurance Work? Here's Our Guide For ... Revealed

If you have no considerable properties as well as you rent out a house rather than owning, then the state minimum degree of insurance coverage is acceptable. If you're really price-sensitive and find that all the top-tier insurance companies are too expensive for your budget, you still have a number of options: Raise your deductible (car insured).

"In some cases you're better off paying a little even more to be with a top quality insurer that will certainly be there when the chips are down," Clark claims (affordable car insurance).

When you compare the rate of auto insurance, it's essential to check out every alternative so that you'll obtain the protection you need at a price you can afford. Below are nine tips for getting the ideal cars and truck insurance bargains.

Or by combining your automobile insurance plan with various other insurance coverage policies, such as house owners insurance or life insurance coverage you can save by bundling as opposed to having private policies - cheapest auto insurance. Keep an excellent credit history ranking A lot of insurance firms will certainly figure in the stamina of your credit rating when identifying the cost of your policy.

Drive carefully It's really that straightforward. If you have at the very least five years of driving experience and no mishaps over the past five years, you might get a safe-driver price cut. As well as with Accident Mercy, we will not raise your vehicle insurance policy rates adhering to the first at-fault vehicle accident. cars. Think about vehicle safety functions and protective driving course You might conserve money on your auto insurance coverage price if your lorry is geared up with an anti-theft device, complete front-seat air bags or restraint gadgets that function automatically when your door closes.

About Best Car Insurance Companies In Connecticut - Coverage.com

Practically every state in America needs some sort of vehicle insurance policy. And also legislations aside, driving without insurance policy can pose a substantial economic threat to you as well as other drivers. That's why putting in the time to locate the best automobile insurance is so vital. Below, we'll walk you via what automobile insurance coverage is, what it covers (and also what it does not!) as well as what affects your auto insurance rate.

Savvy Let a person else shop around for you. Why not get quotes from a few various areas to make sure you're obtaining the absolute finest offer on your car insurance? It conserves individuals a standard of $826 a year.

According to Savvy, 40% of its customers discover a less costly plan than their existing one. The only downside to Savvy is that you can not finish an application on the Wise web site; you need to click over to the insurance firm's web site or call to use.

cheaper car insurance trucks car insurance

cheaper car insurance trucks car insurance

It also offers a number of kinds of insurance policy so you can have all or the majority of your plans with 1 insurer. Generally, Allstate is a good selection and also worth contrasting with other insurance companies to see if it's appropriate for you. It's available in all 50 states and has an A+ ranking from AM Best (cheap auto insurance).

The business has actually come a long way since its starting, but the objective stays the same. Safe and reliable transport is precisely what AAA commits to per the company's core statement. AAA is possibly best understood for its roadside assistance, yet the business supplies a selection of insurance policy coverage and subscriptions.

8 Simple Techniques For Best Car Insurance Companies For April 2022 - Bankrate

cheapest car insurance insurance companies affordable auto insurance low cost

cheapest car insurance insurance companies affordable auto insurance low cost

State Ranch will certainly guarantee a classic automobile as long as the sustaining policies are with them too. State Ranch has a method that every chauffeur can conserve, from earning great grades as a student vehicle driver to incorporating your automobile plan with your homeowners insurance coverage. Best For Rideshare vehicle drivers 6.

A few of the distinct features of the program can help you save money on your plan over time, particularly if you have and also preserve a tidy driving document. This strategy is best for AARP participants that are risk-free vehicle drivers and also wanting to conserve some money on their premium as a result.

Best For Constant tourists that understand the value of quality rental vehicle insurance policy Vehicle proprietors and non-owners who need liability protection Cost-conscious chauffeurs Uninsured drivers that are accredited to drive as well as desire to guarantee a rental car Pros Approximately $35,000 in insurance coverage in key and secondary liability insurance policy 24-hour customer care Usually less costly than rental vehicle insurance coverage at the rental desk Online quotes and claims Cons Have to buy beforehand Key Types of Auto Insurance Coverage Protection Insurance coverage is governed at the state degree, so while lots of Get more information fundamental protections will be comparable, there are some various approaches on insurance coverage alternatives, depending upon the state in which you reside.

Vehicle Med Pay is initially, Uninsured or Underinsured Motorist Bodily Injury & Residential Property Damages Protection, Secures you from without insurance or underinsured chauffeurs In some states, In some states, You and your traveler(s)'s medical expenditures, shed incomes, and also discomfort as well as experiencing * If you do not have this coverage on your lorry, you may not have protection for it (automobile).

cheaper car cheaper car insurance auto insurance company

cheaper car cheaper car insurance auto insurance company

Might or may not have an insurance deductible, relying on your plan * Differs by state as well as provider. Inspect your state laws and insurance policy service provider's needs for specific information. What Affects Cars And Truck Insurance Coverage Fees? Insurance is the transfer of threat from a specific to a pool of people. To make the math work, insurance provider require to understand the danger you represent about the swimming pool.

Not known Details About Best Car Insurance Companies Of 2021 - Insure.com

Credit report, Driving background, Where you live, The sort of automobile your drive, The number of miles you drive, Your driving experience, Gender, Age, Own a home, Current claim patterns, Geographic patterns like legislations or weather condition in an area: Insurance provider have discovered a correlation between credit report ratings as well as the danger of a claim for all significant insurance coverage types. insurers.

It prevails for insurance providers to consider mishaps in the previous 5 years and also tickets or infractions in the previous 3 years. Where you live is a larger deal than you could believe. Urban locations have a lot more automobiles on the roads to run into as well as a lot more interruptions. The repair work or substitute costs may be greater with certain makes or designs - perks.

The safety attributes or collision scores of a certain kind of automobile impact rates.: Every mile driven is a mile in which you can be involved in a crash. Some insurance companies provide a discount rate for reduced gas mileage vehicle drivers. If your gas mileage use is well above the average of about 15,000 miles annually, some insurers will certainly bill extra.

Some insurers will not also create a policy for a vehicle driver with much less than three to five years of driving experience. Different insurance providers begin to offer cost breaks at various ages.

Others begin at age 25, and even 30. Some insurance companies will also bill extra for drivers over the age of 70. Insurance firms normally give lower rates to house owners since they have found a connection in between homeownership and minimized risk. You can additionally bundle your home owner's insurance.: It's not unusual for an insurance firm to increase prices in a state following an event that creates a rise in claims, like a huge storm.

A Biased View of Best Car Insurance Companies For April 2022 - Bankrate

In other situations, a location can be much more expensive due to the fact that the roadways are more greatly crowded. Weather events can additionally be one more driving force that influences prices by region. Hailstorm, wind, and also storms can cause damages to automobiles, create accidents, as well as produce rises in claims. What is Not Covered by Automobile Insurance Coverage? Even the ideal car insurance plan will not cover every little thing (cheaper car).

You wish to check with your insurance policy representative or provider (car). Additionally, if the rental vehicle is damaged, you will certainly not be covered for "loss of usage" when the rental business can not rent out the vehicle to someone else since it is being repaired, or for "decrease", which is the loss of worth for the rental auto also after it is repaired.

With some insurance firms, they have the ability to include an extra endorsement to the car plan to cover rideshare. Talk to your insurance policy agent or service provider to see if this is a choice. Personal effects (laptop computers, phones, and so on) harmed in a crash or stolen from your automobile might be by your car insurance plan.

You want to check with your insurance policy firm.

insurers low cost credit score car

insurers low cost credit score car

These points may seem improbable, and you're a lot more most likely to have a common mishap, but your insurance policy possibly omits all of these risks if any one of them do happen. What is Car Insurance coverage? Like the majority of insurance policy policies, a vehicle insurance policy coverage policy is a legal agreement between you and the insurance firm.

The Main Principles Of Best Car Insurance Companies Of April 2022 - Time

Cars and truck insurance coverage normally uses 3 sorts of coverage, or defense, with various states having different minimum protection mandates. BZ 3 Kinds of Defense in a Car Insurance Coverage: this covers events like burglary or damage to your lorry in an accident.: this offers monetary protection for your or others medical expenses must any result from a crash or event while driving your lorry - credit.